Gemini secures regulatory approval in Singapore amid Asia expansion plans

Gemini, the crypto exchange founded by the Winklevoss twins, has secured regulatory approval from the Monetary Authority of Singapore (MAS) for its Major Payment Institution license. This significant milestone aligns with Gemini's broader strategy to expand its presence in the Asia-Pacific region, particularly in Singapore, which has emerged as a global crypto hub.

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, has secured a significant regulatory approval in Singapore, marking a crucial step in its strategic expansion across the Asian market.

Regulatory Achievement Highlights

- Obtained comprehensive regulatory approval in Singapore

- Demonstrates commitment to regulatory compliance

- Positions Gemini as a credible player in the Asian cryptocurrency landscape

Regulatory Framework

Approval Details

- Secured by Gemini Pte. Ltd.

- Comprehensive regulatory clearance

- Compliance with Singapore's stringent financial regulations

Strategic Significance

- Market Expansion

- Establishes strong foothold in Singapore

- Gateway to broader Asian cryptocurrency markets

- Signals serious commitment to regional growth

- Regulatory Compliance

- Adheres to Singapore's robust financial regulatory environment

- Demonstrates institutional-grade cryptocurrency platform capabilities

- Builds trust with regulators and potential users

Regulatory Context

Singapore's Cryptocurrency Landscape

- Known for progressive yet cautious cryptocurrency regulations

- Attractive destination for global cryptocurrency businesses

- Emphasizes investor protection and financial system integrity

Gemini's Approach

Compliance Strategy

- Proactive regulatory engagement

- Comprehensive risk management

- Transparent operational practices

Market Positioning

- Differentiation through regulatory compliance

- Institutional-grade cryptocurrency services

- Focus on security and user protection

Technological and Operational Capabilities

Platform Features

- Secure cryptocurrency trading infrastructure

- Advanced security protocols

- Comprehensive digital asset management tools

Compliance Mechanisms

- Advanced KYC (Know Your Customer) procedures

- AML (Anti-Money Laundering) frameworks

- Continuous monitoring and risk assessment

Market Implications

Potential Impacts

- Increased credibility in Asian markets

- Enhanced investor confidence

- Potential attraction of institutional investors

Competitive Landscape

- Differentiates from less regulated platforms

- Positions Gemini as a premium cryptocurrency service

- Challenges existing regional cryptocurrency exchanges

Asian Market Dynamics

Regional Cryptocurrency Trends

- Growing institutional interest

- Increasing regulatory clarity

- Expanding digital asset ecosystem

Strategic Considerations

- Navigating diverse regulatory environments

- Understanding local market nuances

- Adapting to regional technological preferences

Founder's Perspective

Winklevoss Twins' Vision

- Long-term commitment to global cryptocurrency adoption

- Focus on regulatory compliance

- Building trustworthy cryptocurrency infrastructure

Future Expansion Plans

- Potential expansion to other Asian markets

- Continued regulatory engagement

- Investment in technological innovation

Technological Innovation

Platform Enhancements

- Continuous security improvements

- Advanced trading technologies

- User-centric design

Security Protocols

- Multi-layer security infrastructure

- Cold storage solutions

- Advanced encryption technologies

Potential Challenges

Market Considerations

- Regulatory complexity

- Competition from local exchanges

- Evolving cryptocurrency landscape

Mitigation Strategies

- Continuous regulatory adaptation

- Investment in local expertise

- Flexible technological infrastructure

Economic and Technological Implications

Broader Cryptocurrency Ecosystem

- Demonstrates maturity of cryptocurrency markets

- Encourages institutional participation

- Promotes regulatory clarity

Technological Innovation

- Drives platform development

- Encourages competitive innovation

- Supports digital asset ecosystem growth

Expert Perspectives

Industry analysts suggest the approval:

- Validates Gemini's strategic approach

- Represents significant milestone in cryptocurrency regulation

- Signals potential for broader market expansion

Final Thought

Gemini's regulatory approval in Singapore represents a strategic breakthrough, showcasing the company's commitment to compliance, innovation, and responsible cryptocurrency ecosystem development.

Recommended Actions

- Stay informed about regulatory developments

- Understand platform capabilities

- Consult financial professionals

- Maintain updated knowledge of cryptocurrency markets

Key Takeaways

- Significant regulatory achievement

- Strategic Asian market expansion

- Commitment to compliance and innovation

FAQ Section

1. What regulatory approval has Gemini received in Singapore?

Gemini has secured comprehensive regulatory approval for its operations in Singapore, allowing it to offer cryptocurrency services in compliance with local regulations.

2. Why is this regulatory approval significant?

This approval positions Gemini as a credible player in the Asian cryptocurrency market, demonstrating its commitment to regulatory compliance and enhancing trust among users and investors.

3. What does this mean for Gemini's operations in Asia?

The approval allows Gemini to establish a strong foothold in Singapore, serving as a gateway to broader opportunities in the Asian cryptocurrency market.

4. How does Gemini ensure compliance with regulations?

Gemini adheres to Singapore's stringent financial regulations through proactive regulatory engagement, comprehensive risk management, and transparent operational practices.

5. What features does the Gemini platform offer?

Gemini provides a secure cryptocurrency trading infrastructure, advanced security protocols, and comprehensive digital asset management tools.

6. What cryptocurrencies can users trade on Gemini?

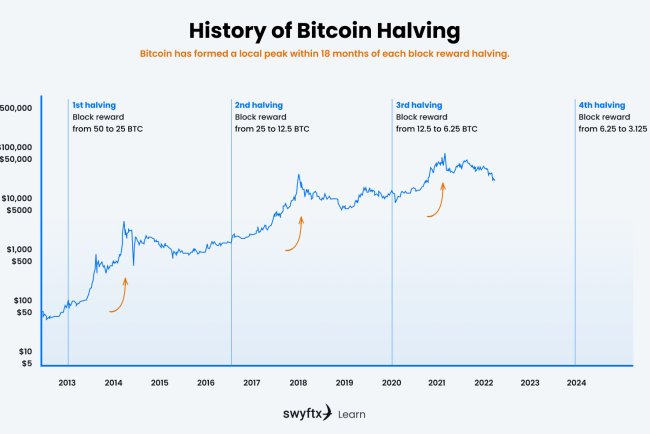

Gemini supports a variety of cryptocurrencies, including major assets like Bitcoin (BTC) and Ethereum (ETH), among others.

7. How does Gemini prioritize security?

Gemini employs multi-layer security infrastructure, cold storage solutions, and advanced encryption technologies to protect user assets and data.

8. What are the potential benefits for investors using Gemini?

Investors can benefit from increased credibility, enhanced security, and a user-friendly trading experience, all backed by regulatory compliance.

9. How does this approval impact the competitive landscape in Asia?

Gemini's regulatory approval differentiates it from less regulated platforms, positioning it as a premium cryptocurrency service and potentially attracting institutional investors.

10. What are Gemini's future expansion plans in Asia?

Gemini aims to explore opportunities in other Asian markets, continue engaging with regulators, and invest in technological innovation to enhance its platform.

11. How does this approval affect the broader cryptocurrency ecosystem?

Gemini's approval signifies the maturity of cryptocurrency markets in Asia, encourages institutional participation, and promotes regulatory clarity in the region.

12. What challenges might Gemini face in the Asian market?

Gemini may encounter regulatory complexities, competition from local exchanges, and the need to adapt to diverse market conditions.

13. How can users stay informed about Gemini's developments?

Users can follow Gemini's official website, subscribe to newsletters, and monitor cryptocurrency news platforms for updates on regulatory changes and platform enhancements.

14. Is Gemini planning to expand its services beyond Singapore?

Yes, Gemini has indicated interest in expanding its services to other Asian markets as part of its growth strategy.

15. Where can I find more information about Gemini's services?

For more information, visit Gemini's official website or consult their customer support for specific inquiries regarding services and features.

What's Your Reaction?