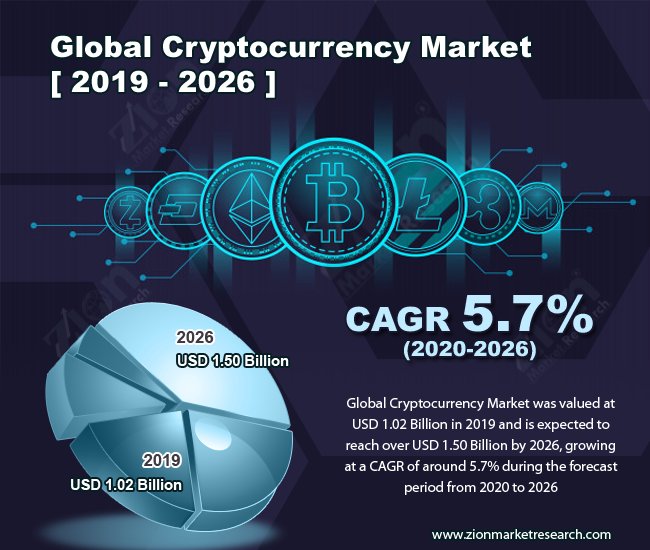

Cryptocurrency Market Sees Mixed Movements Amidst Investor Caution

Bitcoin experiences slight declines while Ethereum shows modest gains. Explore market analysis, expert insights, and key Ethereum metrics shaping the current crypto landscape.

As of February 23, 2025, the cryptocurrency market is experiencing varied trends, with Bitcoin (BTC) showing slight declines and Ethereum (ETH) demonstrating modest gains.

Market Analysis

Bitcoin's price has seen a minor decrease, currently trading at $96,319.00, down 0.00135% from the previous close. The intraday high reached $96,900.00, with a low of $96,136.00. This slight downturn may be attributed to ongoing investor caution and market consolidation.

In contrast, Ethereum is exhibiting a modest upward trend, trading at $2,791.44, reflecting an increase of 0.03827% from the previous close. The intraday high stands at $2,796.20, with a low of $2,679.35. This positive movement suggests growing interest and activity within the Ethereum network.

Expert Opinions

Market analysts suggest that Bitcoin's current price movement indicates a phase of consolidation, with investors closely monitoring macroeconomic factors and regulatory developments. The slight decline is viewed as a natural market correction following previous gains.

Regarding Ethereum, experts point to the network's increasing utility and user engagement as key drivers for its price appreciation. The rise in active addresses and network growth indicates a healthy and expanding ecosystem, which may contribute to sustained upward momentum.

Ethereum Metrics Overview

-

Active Addresses and Network Growth: Recent data indicates a rise in active Ethereum addresses and network growth, suggesting increased utility and user engagement. This uptick is a positive indicator of the network's health and adoption rate.

-

Market Value to Realized Value (MVRV) Ratio: The MVRV ratio, which compares Ethereum's market capitalization to its realized capitalization, has shown fluctuations. A higher MVRV ratio may indicate overvaluation, while a lower ratio could suggest undervaluation. Monitoring this metric provides insights into potential market corrections.

-

Top Holders: Analysis of the top 100 Ethereum addresses reveals trends in accumulation or distribution among major stakeholders. Changes in holdings by these top addresses can influence market sentiment and price movements.

What's Your Reaction?