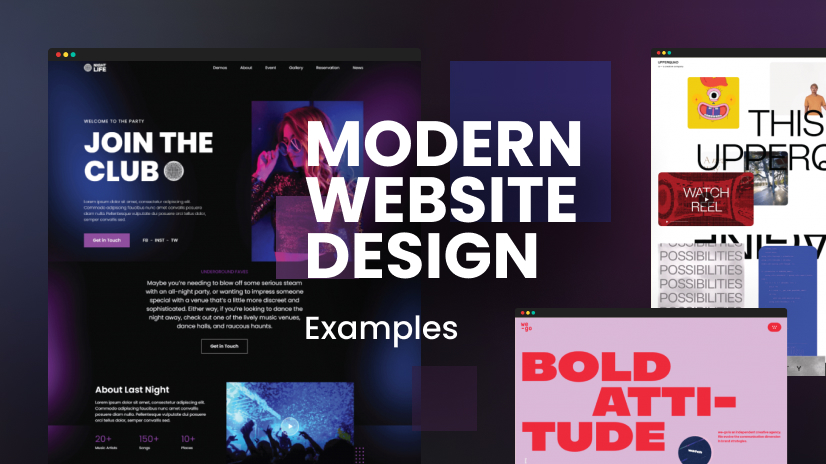

Bitcoin's Ponzi Scheme Paradox: Unraveling Misconceptions Amid Market Dynamics

Explore the misconceptions surrounding Bitcoin's association with Ponzi schemes, current market analysis, expert insights, and key Ethereum metrics shaping the cryptocurrency landscape.

As of February 23, 2025, Bitcoin (BTC) is trading at $96,215.00, reflecting a slight decrease of 0.00278% from the previous close. The intraday high reached $96,900.00, with a low of $96,136.00. This minor fluctuation indicates a period of market stability following recent volatility.

The Ponzi Scheme Allegation

Critics have often labeled Bitcoin as a Ponzi scheme, a fraudulent investment operation where returns are paid to earlier investors using the capital of newer investors. However, this characterization overlooks fundamental differences. Unlike Ponzi schemes, Bitcoin operates on a decentralized network without a central authority promising guaranteed returns. Its value is determined by market demand and supply dynamics, not by the influx of new investors. This decentralized nature and transparent ledger system distinguish Bitcoin from traditional fraudulent schemes.

Market Analysis

Bitcoin's current price movement suggests a consolidation phase. The cryptocurrency has experienced a series of highs and lows over the past months, influenced by macroeconomic factors, regulatory developments, and market sentiment. Analysts observe that Bitcoin's resilience amid global economic uncertainties reinforces its position as a digital store of value.

Expert Opinions

Financial experts argue that labeling Bitcoin as a Ponzi scheme stems from a misunderstanding of its underlying technology and economic model. Unlike fraudulent schemes that collapse when new investments cease, Bitcoin's blockchain continues to function independently, with miners and nodes maintaining the network. The absence of promised returns and the open-source nature of Bitcoin further refute the Ponzi scheme allegation.

Ethereum Metrics Overview

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is currently priced at $2,780.03, marking an increase of 0.03381% from the previous close. The intraday high is $2,792.69, with a low of $2,679.35. Key metrics for Ethereum include:

-

Network Value Indicators: Recent analyses suggest that Ethereum's native token might be overvalued, with certain network value indicators forecasting a potential price correction.

Market Value to Realized Value (MVRV) Ratio: This metric compares Ethereum's market capitalization to its realized capitalization. A higher MVRV ratio may indicate overvaluation, while a lower ratio could suggest undervaluation.

-

Total Value Locked (TVL): Representing the total capital held within Ethereum-based decentralized applications, TVL serves as a barometer for network utility and user engagement. Fluctuations in TVL can reflect changes in investor confidence and the overall health of the DeFi ecosystem.

-

Gas Fees: The cost associated with executing transactions on the Ethereum network, known as gas fees, can influence user activity. Elevated fees might deter participation, whereas lower fees could encourage more transactions and smart contract deployments.

What's Your Reaction?